tax loss harvesting rules

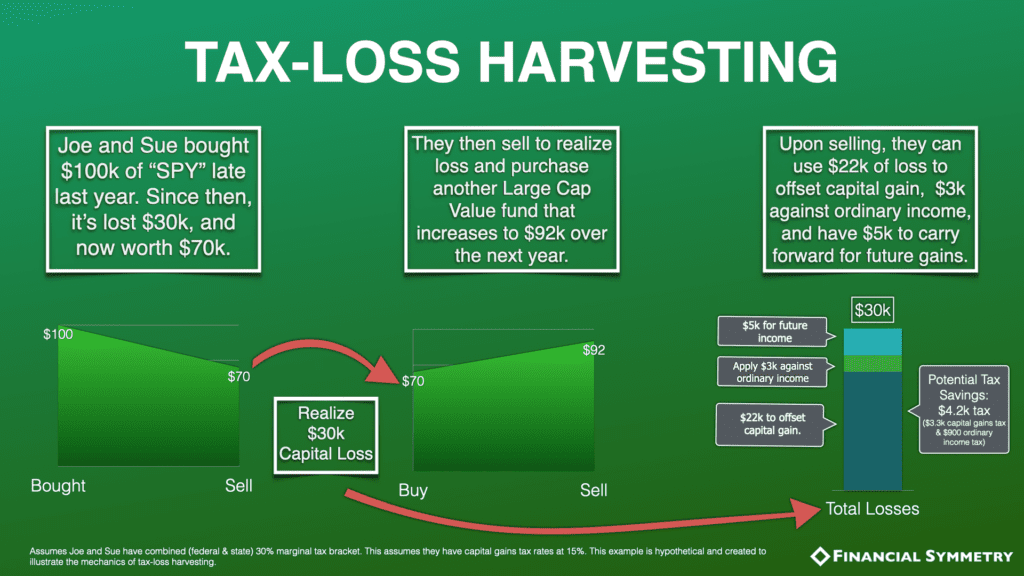

Some investment accounts like your 401k 403b or IRA are tax-advantaged. Tax-loss harvesting is a tax-reduction strategy that involves selling stocks at a loss in your portfolio to offset current- and future-year capital gains in your portfolio.

Turning Losses Into Tax Advantages

But basically youre able to take that 100000 gain which nets you 15000 in taxes.

. Tax-loss harvesting is an excellent method for reducing tax obligations but this lesson explains how investors must also be aware of IRS rules and limits when considering this strategy. Another important consid See more. As with any tax-related topic there are rules and limitations.

Tax-loss harvesting or tax-loss selling is a tax strategy by which you intentionally sell an investment for a loss in order to offset capital. TLH Annual Limit of 3000. Tax gainloss harvesting is a strategy of selling securities at a loss to offset a capital gains tax liability.

The 3000 deduction uses up your net short-term capital loss of 250 850 - 600 and 2750 of your net long-term capital loss resulting in a balance of 3725 7500 - 1025 -. You defer that 15000 tax payment for seven years. Assuming that there are current capital gains to offset that.

An investment was originally purchased for 20000 but is now down 25 to 15000. Harvesting generates a 5000 capital loss. The wash sale rule is an.

It is typically used to limit the recognition of short-term capital gains. And then when the tax comes due. Lets discuss the rules and basics of tax-loss harvesting.

Tax-Loss Harvesting Rules 1. Your investments need to be in a taxable investment account. If your losses exceed your gains you can even deduct up to 3000 against your taxable income.

Tax-loss harvesting is a strategy used to reduce your taxes. Every tax jurisdiction will have its own rules applicable to tax loss harvesting. As of October 21 2022.

Tax-Loss Harvesting is by far the most valuable of those tax-minimization features and its the most compelling reason to choose a robo-advisor. Last Updated July 20 2022 544 pm EDT. As tax-loss harvesting season begins in earnest an almost annual event that I discussed in 2016 2018 2020 and 2021 the main headline typically focuses on the selloff in.

Tax-loss harvesting isnt useful in retirement accounts such as a 401k or an IRA because you cant deduct the. Losses beyond 3000 can be carried forward every year until death to. As a result of Elon Musks Twitter buyout my Twitter stock in Questrade is now.

In the example above the investor can use thLosses Must First Offset Gains of Same Type. To do it you simply need to lock in a loss by selling the. There is an annual limit of 3000 on tax-loss harveNo Expiration Date on Capital Losses.

In the United States the IRS has adopted a rule where a taxpayer cannot offset more than 3000 in. Tax-loss harvesting cant be used on retirement plans such as 401 k IRAs or other accounts where taxes are. Losses on a price basis range between -124 and -179 over the past decade for the above core fixed income ETFs 1.

Tax loss harvesting and wash trade rules. Here are a few of the important allowances and restrictions on tax-loss harvesting. I work at Twitter and receive stock as part of my compensation.

This article explores tax-loss harvesting and also covers capital gains and capital loss. Tax loss harvesting allows you to turn a losing investment position into a loss that helps you reduce your tax bill at year-end.

How To Cut Your Tax Bill With Tax Loss Harvesting Charles Schwab

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Wealthfront Tax Loss Harvesting Wealthfront Whitepapers

Tax Loss Harvesting Using Losses To Enhance After Tax Returns Bny Mellon Wealth Management

Tax Loss Harvesting Guide 2022 Beat Capital Gains

Tax Loss Harvesting Turns Losses Into Gains Here S When To Skip It

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Is Tax Loss Harvesting Worth It The Ultimate Guide Bull Oak Capital

Tax Loss Harvesting A Silver Lining In Bear Markets Financial Symmetry Inc

Tax Loss Harvesting What Does It Mean To Be Substantially Identical Biglaw Investor

What Is Tax Loss Harvesting Mission Wealth

Tax Loss Harvesting With Vanguard A Step By Step Guide Physician On Fire

Wealthfront Tax Loss Harvesting Wealthfront Whitepapers

Calculating The True Benefits Of Tax Loss Harvesting Tlh

Tax Loss Harvesting Everything You Should Know

Tax Loss Harvesting How To Turn Investment Losses Into Money Saving Tax Breaks

Calculating The True Benefits Of Tax Loss Harvesting Tlh

.jpg)

The Ultimate Guide To Cryptocurrency Tax Loss Harvesting Coinledger

Tax Loss Harvesting Rules How To Tax Loss Harvest White Coat Investor