what food items are taxable in massachusetts

This guide is not designed to address all questions which. Its sales tax base is narrowly defined however.

Amazon Will Pay 0 In Federal Taxes This Year

Most food is exempt from sales tax.

. This also includes a general listing of items that are exempt from the Massachusetts sales and use tax. It must be sold in the same form and condition quantities and packaging as is. It must be sold unheated.

This raises obvious questions about a host of other food items like chips baked goods and ice cream. Massachusetts imposes a 625 sales and use tax on all tangible physical products being sold to a consumer and on certain services. It must be sold for human consumption.

Food must meet these conditions to be exempt from tax. Counties and cities are not allowed to collect local sales taxes. Although Massachusetts still levies a 625 percent sales tax on most tangible items there are quite a few exemptions including food healthcare items and more.

Most items that cost less than 175 are exempt from sales tax including everyday shoes and even shoelaces items. This guide includes general information about the Massachusetts sales and use tax. Heated foods salads and sandwiches and cheese and finger-food platters under 4 will.

Learn more about Massachusetts Department of Revenue DOR Guide to. In addition to exempting food clothing prescriptions and other basic necessities Massachusetts exempts most services several manufacturing business inputs and several. Collecting sales tax when 4-H groups sell products Even though 4-H is an organization that is not required to pay income tax to the state or federal government 4-H organizations are not exempt from paying sales tax on items they purchase and may be required to collect a 5 sales tax on the products they sell.

Massachusetts law makes a few exceptions here. Massachusetts has one sales tax holidays during which certain items can be purchased sales-tax free. 44 rows In the state of Massachusetts sales tax is legally required to be collected from all tangible.

Exact tax amount may vary for different items. Grocery items are generally tax exempt in Massachusetts. The exemption for food includes.

It describes the tax what types of transactions are taxable and what both buyers and sellers must do to comply with the law. The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam or certain telecommunications services 1 sold or rented in Massachusetts. Candy and soda may be included or excluded from any preferential tax rate depending on whether or not the state considers them to be a grocery.

Groceries and prescription drugs are exempt from the Massachusetts sales tax. Whole Foods charges sales tax on loose bagels up to six the salad bar and some herbal teasI can understand paying tax if Iâm eating there but when part of a large grocery order and. These businesses include restaurants cafes food trucks or stands coffee shops etc.

This includes soft drinks candy and other food types that many other states consider taxable. 2022 Massachusetts state sales tax. Are groceries taxable in Massachusetts.

The buyer pays the sales tax as an addition to the purchase price to the vendor at the time of purchase. Food sold by a business that is primarily engaged in the business of selling meals is taxable at the Massachusetts meals tax rates. Groceries are generally defined as unprepared food while pre-prepared food may be subject to the restaurant food tax rate.

Below are some of the more interesting ones weve found. 53 rows When foods are categorized as necessities based on nutritional value soda and candy are among the first products to be added to the taxable list. The Massachusetts state sales tax rate is 625 and the average MA sales tax after local surtaxes is 625.

Food sold by a business that is primarily engaged in the business of selling meals is taxable at the Massachusetts meals tax rates. Candy IS considered a grocery in Massachusetts.

7 Things To Know About The Sales Tax Holiday In Mass This Weekend

Pin On Breads Biscuits Muffins

Seafood Boxes Delivery Seafood Box Knowseafood

Dba Vs Llc Core Differences You Should Know Forbes Advisor

Delivery Service Hidden Charges Class Action Lawsuits An Overview Top Class Actions

Pin On Breads Biscuits Muffins

Definitive Proxy Statement Def 14a

Salmon Burgers Buy Online Knowseafood

Pin On Breads Biscuits Muffins

Easy Vegan Sourdough Veggie Fritters The Colorful Kitchen Recipe Veggie Fritters Fritters Easy Vegan

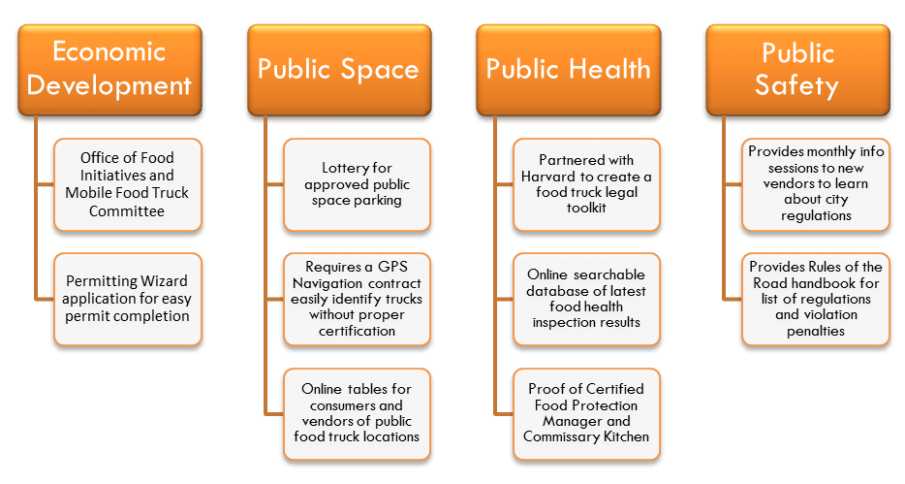

Case Study On The Go Insights Into Food Truck Regulation In Us Cities Data Smart City Solutions

Seafood Boxes Delivery Seafood Box Knowseafood

Pin On Breads Biscuits Muffins

Best Cbd How To Identify The Best Quality Cbd Goodrx