nso stock option tax calculator

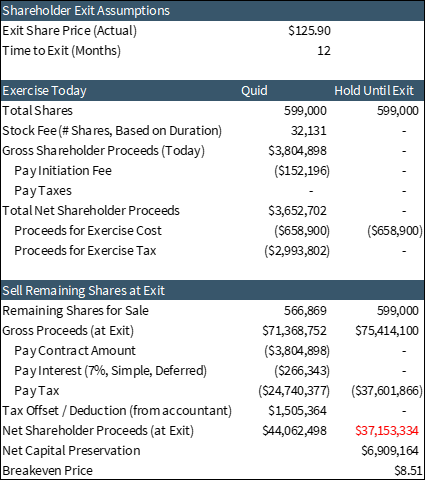

Youve made a 81 net gain on your NSO 150 52 sale tax 17. The tool will estimate how much tax youll pay plus your total return on your non.

Eso Fund Helps You To Plan The Best Time To Exercise Your Employee Stock Options Consider Some Factors Like Vesting Date Expirati Stock Options Tax Incentive

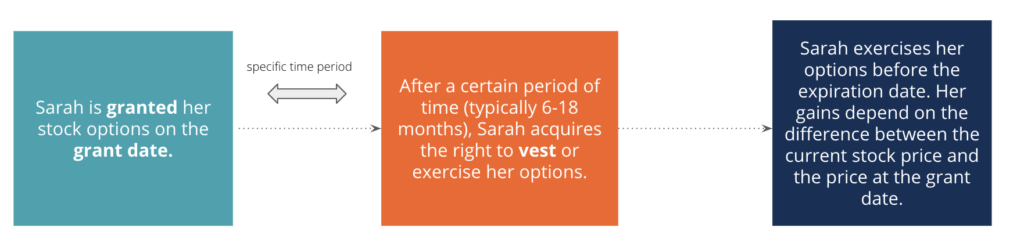

A NSO is a type of employee stock option that gives an employee the right to purchase company stock at a certain price called the exercise or strike price.

. Remember you actually came out well ahead even after taxes since you sold stock for 4490 after paying the 10 commission that you purchased for only 2500. How much are your stock options worth. Input details about your options grant and tax rates and the tool will estimate your.

The Lifecycle of a Non-Qualified Stock Option NQSO. The calculator is very useful in evaluating the tax implications of a NSO. A stock option is a right to buy a set number of shares of the companys common stock at a set price the exercise price.

Stock Option Tax Calculator. I would assume being an. It is also a type of stock-based compensation.

Nso Stock Option Tax Calculator. NSO Tax Occasion 1 - At Exercise. Incentive Stock Option ISO Calculator.

This permalink creates a unique url for this online calculator with your saved information. A non-qualified stock option NSO is a form of equity compensation that can be provided to employees and other stakeholders. Non qualified stock option NSO is one where employees are taxed both while purchasing the stock exercising options as well as while selling the stock.

This calculator can be used to estimate the number of shares you may own after you do a cashless exercise net-exercise of non-qualified stock options. The Stock Option Plan specifies the employees or class of employees eligible to receive options. An NSO gives recipients the choice to purchase.

Calculate the costs to exercise your stock options - including taxes. Click to follow the link and save it to your Favorites so. On this page is a non-qualified stock option or NSO calculator.

Ad Fidelity Can Help You Manage Risk and Plan For the Future You Desire. When you exercise an NSO you pay the company who issued the NSO the exercise price also known as the strike price to buy a share. Typically tax is withheld for.

The Stock Option Plan specifies the total number of shares in the option pool. Which means youd be taxed at 15 instead of 32. In the event that you are unable to calculate the gain in a particular exercise scenario you can use the.

On this page is a non-qualified stock option or NSO calculator. Of course the stock price could fall back to. The Lifecycle of a Non-Qualified Stock Option NQSO.

This explains why employee stock options are a type of deferred compensation used to motivate and retain employees. A non-qualified stock option NSO is a type of employee stock option wherein you pay ordinary. ISOs are attractive due to their preferential tax.

Images posts videos related to Nso Stock Option Tax Calculator Entrepreneurs guide to options. A non-qualified stock option NSO is a type of stock option used by employers to compensate and incentivize employees. On this page is an Incentive Stock Options or ISO calculator.

Stock Option Tax Calculator. The tool will estimate how much tax youll pay plus your total return on your. Ad Fidelity Can Help You Manage Risk and Plan For the Future You Desire.

This would result in a tax bill of 3750 instead of 8000. The stock option agreement refers to the plan as an Incentive Stock Option ISO plan even though I was an Independent Contractor for the company. A non-qualified stock option NSO is a type of employee stock option wherein you pay ordinary income tax on the difference between the grant price and the price at which you.

Understand how and why to leverage. 50 25 1000 15. NSOs do not require employment and.

January 29 2022.

Stock Option Vs Rsu Top 7 Differences To Learn With Infographics

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

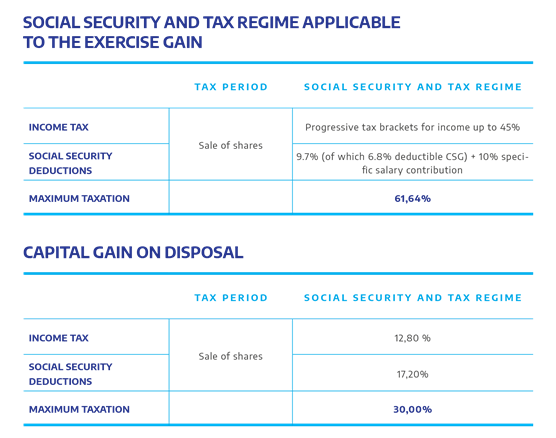

Tax Planning For Stock Options

Non Qualified Stock Options Nsos

Non Qualified Stock Options Explained Plus What They Mean For Your Company S Taxes Warren Averett Cpas Advisors

Non Qualified Stock Option Nso Overview How It Works Taxation

Video Included What Is An Employee Stock Option Mystockoptions Com

How Much Are My Options Worth Eso Fund

Stock Options So Welcome To France

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-04-52eec5a4f6cd44fd92b693355b916f33.jpg)

Employee Stock Option Eso Definition

Proposed Changes To Stock Option Taxation

Eigenkapital Fur Arbeitnehmer In Der Schweiz Ledgy

/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

:max_bytes(150000):strip_icc()/dotdash_Final_Get_the_Most_Out_of_Employee_Stock_Options_Oct_2020-01-e28cc3504d694dcaaa7a45dfed666f0b.jpg)

Get The Most Out Of Employee Stock Options

:max_bytes(150000):strip_icc()/dotdash_Final_Employee_Stock_Option_ESO_Sep_2020-01-270d01a202284fcc98be049a8cdbbb40.jpg)

Employee Stock Option Eso Definition

Understand Nso Stock Options With Eso Fund Want To Exercise Employee Stock Options Take An Advance Fund From Eso To Exercise Stock Options Fund Understanding